Public Debate Grows Over Rumored ₱3,000 Monthly Increase in SSS Pensions Starting January 2026

In recent weeks, discussions across social media, community groups, and informal gatherings have intensified following widespread claims of a ₱3,000 monthly increase in Social Security System (SSS) pensions beginning in January 2026. For many retirees and contributors, the possibility of additional financial support has brought a mix of hope, excitement, and confusion. At the same time, questions about eligibility, coverage, and official confirmation have fueled debate nationwide.

While no final announcement has yet been formally released through official SSS channels, the discussion itself highlights a deeper concern shared by many Filipinos: the need for sustainable retirement income amid rising living costs. Understanding how pension adjustments work, who may qualify if an increase is approved, and what factors determine eligibility is essential to separating expectation from reality.

Where the Rumor Began

The initial reports appeared in online posts claiming that a ₱3,000 across-the-board increase would be added to monthly pensions starting early 2026. These posts were widely shared, often accompanied by incomplete lists of supposed beneficiaries or simplified explanations that lacked official references.

As the information spread, reactions quickly followed. Some pensioners welcomed the idea as long overdue relief, while others questioned its feasibility. The absence of a clear official statement allowed assumptions to grow, turning a rumor into a national talking point.

Why Pension Increases Matter

Pension adjustments have always been a sensitive issue, particularly for retirees who depend on fixed monthly income. Over time, rising costs for food, utilities, healthcare, and transportation have significantly reduced purchasing power, especially for senior citizens.

For many pensioners:

The monthly SSS pension is their primary or only source of income

Even small increases can affect daily necessities

Stability matters more than large but uncertain promises

This context explains why the rumored increase resonated strongly and why emotions escalated so quickly once the topic gained traction.

Understanding How SSS Pension Adjustments Work

Before discussing who might benefit from a possible increase, it is important to understand how SSS pension adjustments are typically determined.

SSS pension changes are not automatic. They usually depend on several factors, including:

Actuarial studies on fund sustainability

Approval by the Social Security Commission

Compliance with existing laws and regulations

Financial capacity of the SSS fund

Any increase must balance the welfare of current pensioners with the long-term stability of the system, ensuring that future retirees are not disadvantaged.

Is a ₱3,000 Increase Realistic?

A uniform ₱3,000 monthly increase would represent a significant financial commitment. Historically, pension adjustments have often been incremental rather than large, across-the-board amounts.

Experts often note that pension increases usually:

Differ based on pension amount or contribution history

Prioritize lower-income pensioners

Are implemented in phases

This does not mean an increase is impossible, but it suggests that if approved, it may not apply equally to all recipients.

Who Could Be Eligible If an Increase Is Approved?

One of the most debated questions is who would qualify if any pension increase is implemented. While no final criteria have been announced, past policies provide clues about how eligibility is commonly structured.

Potential considerations may include:

1. Current Pensioners

Individuals already receiving monthly retirement, disability, or survivor pensions would likely be the primary group considered. However, the amount of increase, if any, may vary.

2. Length of Contribution

Pensioners with longer contribution periods may be treated differently from those with minimal qualifying years.

3. Pension Amount Brackets

Lower pension brackets are often prioritized to reduce inequality among retirees.

4. Type of Pension

Retirement, disability, and survivor pensions are sometimes addressed separately, depending on policy objectives.

Who Might Be Excluded?

Equally important is understanding who may not qualify under certain adjustment proposals. In previous pension reforms, exclusions have sometimes applied to:

Lump-sum beneficiaries rather than monthly pensioners

Individuals who have not met minimum contribution requirements

Accounts with unresolved documentation or compliance issues

These exclusions often spark disappointment, especially among those who expected automatic inclusion.

The Role of Contribution History

Contribution history plays a critical role in pension computation. Monthly pension amounts are influenced by:

Total number of contributions

Average monthly salary credit

Age at retirement

Any adjustment may still be tied to these factors, reinforcing the principle that pensions reflect long-term participation in the system.

Why Official Confirmation Matters

The lack of an official announcement has created uncertainty. Without confirmation, misinformation can spread easily, leading to unrealistic expectations or unnecessary anxiety.

Authorities typically emphasize that:

Official announcements are released through verified SSS channels

Draft proposals are not final decisions

Public consultations may be required before implementation

Relying on unofficial sources can result in misunderstandings that are difficult to correct once widely shared.

Managing Expectations Among Pensioners

Community leaders and financial advisors have urged pensioners to remain cautious. While optimism is understandable, planning based on unverified information can lead to financial strain.

Recommended approaches include:

Maintaining current budgeting plans

Avoiding financial commitments based on rumors

Monitoring official announcements regularly

These steps help protect retirees from sudden disappointment if expectations are not met.

Public Reaction and Social Debate

Online discussions reflect a broad range of opinions. Some argue that a pension increase is essential for dignity and well-being in retirement. Others raise concerns about sustainability and fairness to active contributors.

Common questions raised include:

Will younger workers bear higher contribution burdens?

Can the fund sustain a major increase long term?

Should increases be targeted rather than universal?

These debates highlight the complexity of pension reform.

The Broader Context of Retirement Security

The conversation around SSS pensions is part of a larger discussion about retirement security in the Philippines. Many workers rely almost entirely on SSS benefits, making policy decisions deeply personal and impactful.

Long-term solutions often discussed include:

Strengthening contribution compliance

Encouraging voluntary savings

Improving financial literacy

Pension increases, while helpful, are only one part of a broader system.

What Pensioners Should Do Now

Until official guidance is released, pensioners are advised to:

Verify information through official SSS platforms

Consult SSS offices for personalized inquiries

Stay informed without spreading unconfirmed claims

Responsible sharing helps maintain clarity and trust within communities.

Possible Next Steps from Authorities

If an increase is under consideration, authorities may:

Release clarifications to address public concern

Publish eligibility guidelines

Announce timelines for implementation

Transparency is essential in maintaining public confidence.

Conclusion

The rumor of a ₱3,000 monthly SSS pension increase starting January 2026 has captured public attention and sparked intense debate. While the idea offers hope to many, it also raises important questions about eligibility, sustainability, and fairness.

At present, no official confirmation has been made, and any discussion should be approached with caution. Understanding how pension systems work, recognizing the importance of verified information, and managing expectations responsibly are crucial steps as the public awaits clarity.

As discussions continue, one thing is clear: the conversation reflects the shared desire of Filipinos for security, dignity, and stability in retirement. Whatever the final outcome, transparent communication and informed decision-making will remain key to ensuring trust in the system moving forward.

News

Kim Chiu Candidly Addresses Her Real Relationship Status With Paulo Avelino on It’s Showtime

Kim Chiu once again captured the attention of viewers and netizens after a light yet meaningful exchange on It’s Showtime subtly revealed…

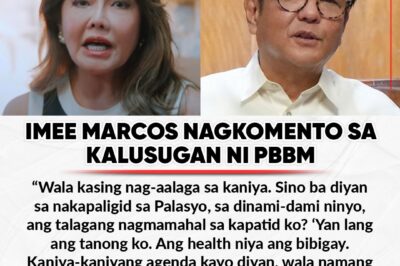

‘Wala kasing nag-aalaga!’ Imee Marcos nagkomento sa kalusugan ni PBBM

Wala umanong nag-aalaga kay Pangulong Ferdinand Marcos Jr. sa Malacañang kaya ito nagkasakit. Ito ang naging pahayag ni Senadora Imee…

One hour before the wedding, I accidentally overheard my fiancé whispering to his mother: “I don’t care about her; I only want her money.” I wiped my tears in silence, walked to the altar with my head held high, and instead of saying “I do,” I said something that made my mother-in-law clutch her chest right there in the middle of the hall…

An hour before the wedding, I, María Elena , stood alone in the hotel’s side corridor, trying to calm my nerves. The…

My husband shook me awake in the middle of the night. “Get up—backyard, now!”

My husband shook me awake in the middle of the night. “Get up—backyard, now!” We hid in the bushes in…

Fans Swoon as Kim Chiu Opens Up About Her Relationship With Paulo Avelino

The online world was filled with excitement and warm reactions after actress Kim Chiu recently made subtle yet meaningful remarks…

Pinay Celebrities Who Parted Ways With Their Foreigner Husbands

In the world of show business, love is often portrayed as a force that knows no boundaries. Language differences, cultural…

End of content

No more pages to load