Understanding Recent Discussions About Bank-Related Adjustments and Pension Payments

In recent days, discussions circulating online and in community conversations have drawn significant attention from retired individuals and their families. Reports suggesting that the Social Security System (SSS) may be reviewing or adjusting certain bank-related procedures have sparked a wave of concern. For many pensioners who rely on regular payments to manage daily expenses, any hint of change can feel unsettling.

As information spread quickly, questions emerged almost immediately. Some worried about whether pension deposits could be affected, while others urged calm, emphasizing the importance of reading information carefully and avoiding premature conclusions. The situation highlights how easily uncertainty can grow when complex financial topics are discussed without sufficient context.

This article aims to explore the issue from a balanced perspective, focusing on clarity rather than speculation and understanding rather than alarm.

Why Pension-Related News Often Triggers Strong Reactions

For retired individuals, pension payments represent stability. These funds often cover essential needs such as food, utilities, medical care, and housing-related costs. Because of this, any discussion involving banking procedures or payment systems naturally draws attention and concern.

Unlike discretionary income, pensions are planned around predictability. Even small changes in processing or documentation can feel significant, especially for those who depend on timely deposits. As a result, reactions to partial or unclear information tend to be immediate and emotional.

Understanding this emotional context is essential when examining why such news spreads quickly and why discussions become heated.

The Nature of Banking and Administrative Adjustments

Large institutions like SSS regularly review their processes. These reviews are often routine and aimed at improving efficiency, accuracy, and security. In many cases, such adjustments involve coordination with partner banks, updates to verification procedures, or alignment with broader financial regulations.

It is important to note that reviews or adjustments do not automatically mean disruption. In fact, they are frequently designed to prevent future issues rather than create new ones. However, when details are shared without explanation, they can easily be misunderstood.

Administrative updates are common in financial systems worldwide and are usually implemented gradually, with notice provided to those affected.

How Partial Information Can Create Unnecessary Anxiety

One of the main challenges in today’s information environment is the speed at which incomplete messages travel. Headlines or short summaries often lack the context needed to understand the full picture.

When readers encounter phrases suggesting “changes” without explanation, it is natural to imagine worst-case scenarios. This reaction is amplified when discussions take place in online spaces where opinions, assumptions, and interpretations mix freely.

Calm and careful reading is essential. Understanding whether a change affects internal procedures, optional services, or mandatory requirements makes a significant difference in how the information should be interpreted.

Clarifying Common Concerns Among Pensioners

Several recurring questions have appeared in public discussions. One of the most common is whether pension deposits will be delayed. Another concerns whether retirees need to take immediate action or submit new documents.

In many situations, procedural updates do not require immediate action from beneficiaries. Often, banks and institutions coordinate behind the scenes to ensure continuity. When action is required, official channels typically provide clear instructions.

It is also important to distinguish between temporary processing adjustments and long-term policy changes. The former usually has minimal impact on beneficiaries, while the latter is communicated well in advance.

The Role of Official Communication

When dealing with financial matters, official communication remains the most reliable source of information. Institutions like SSS typically release notices through their websites, customer service channels, and partner banks.

Relying on verified updates helps prevent confusion. While community discussions can be helpful for sharing experiences, they should not replace official guidance.

Taking time to verify information before reacting can reduce stress and support better decision-making.

Why Banks and Institutions Update Procedures

Financial systems operate in changing environments. Advances in technology, evolving regulations, and emerging security considerations all influence how institutions manage transactions.

Updates may involve strengthening verification processes, improving digital systems, or aligning with national financial standards. These measures are often intended to protect account holders and ensure long-term reliability.

While change can feel inconvenient at first, it is often introduced to reduce risks and improve service quality over time.

Understanding the Difference Between Regulation and Restriction

One source of confusion in public discussions is the assumption that regulation automatically means restriction. In reality, regulation often focuses on clarity, transparency, and consistency.

For example, updated guidelines may clarify how banks handle account verification or reporting, without limiting access to funds. Such distinctions are important, as they influence how changes should be perceived.

Reading beyond headlines helps reveal whether a development represents a limitation or simply an administrative refinement.

Encouraging a Calm and Informed Response

Emotional reactions are understandable, but they can sometimes lead to unnecessary worry. Encouraging a calm approach benefits both individuals and communities.

Taking time to review complete information, consulting official sources, and discussing concerns respectfully can prevent misinformation from spreading. This approach also allows institutions to address questions more effectively.

A measured response supports clarity and confidence, especially during periods of adjustment.

The Importance of Financial Literacy in Retirement

Moments like these highlight the value of financial literacy. Understanding basic concepts related to banking procedures, payment systems, and institutional communication empowers retirees to navigate changes with confidence.

Financial literacy does not require advanced technical knowledge. Simple awareness of how pension systems operate and how updates are communicated can make a meaningful difference.

Educational efforts and community support play an important role in strengthening this understanding.

Community Discussions: Helpful or Harmful?

Community conversations can provide reassurance when individuals share similar experiences. However, they can also amplify uncertainty if speculation replaces verified information.

Balancing community input with official updates ensures that discussions remain constructive. Asking questions is healthy, but drawing conclusions too quickly can increase tension.

Encouraging fact-based dialogue supports collective understanding.

The Value of Patience During Transitions

Administrative changes, when they occur, are rarely instantaneous. Transition periods allow institutions to adjust systems and address unforeseen issues.

Patience during these periods helps prevent unnecessary stress. Most institutions aim to maintain continuity and minimize disruption, especially for vulnerable groups such as retirees.

Understanding that transitions are part of long-term system maintenance can ease concerns.

Protecting Peace of Mind in an Information-Rich Age

Constant exposure to updates, opinions, and commentary can be overwhelming. For retirees, maintaining peace of mind is as important as managing finances.

Limiting exposure to unverified information, setting boundaries around news consumption, and focusing on trusted sources can help maintain balance.

Well-being includes emotional stability as well as financial security.

Looking Ahead With Perspective

While discussions about potential banking-related updates may continue, it is important to view them within a broader context. Financial systems evolve, and institutions adapt to ensure sustainability and reliability.

Change does not automatically signal risk. Often, it reflects ongoing efforts to improve service and security.

Approaching developments with curiosity rather than fear allows individuals to stay informed without feeling overwhelmed.

Conclusion: From Uncertainty to Understanding

News involving pensions and banking procedures naturally attracts attention, particularly among retirees who depend on consistent income. However, not every report signals disruption or loss.

By focusing on verified information, understanding the nature of administrative adjustments, and maintaining a calm perspective, individuals can navigate uncertainty more confidently. Discussions benefit from patience, clarity, and respect for facts.

Ultimately, awareness—not anxiety—is the most helpful response. When information is approached thoughtfully, even potentially unsettling news can become an opportunity for greater understanding and reassurance.

News

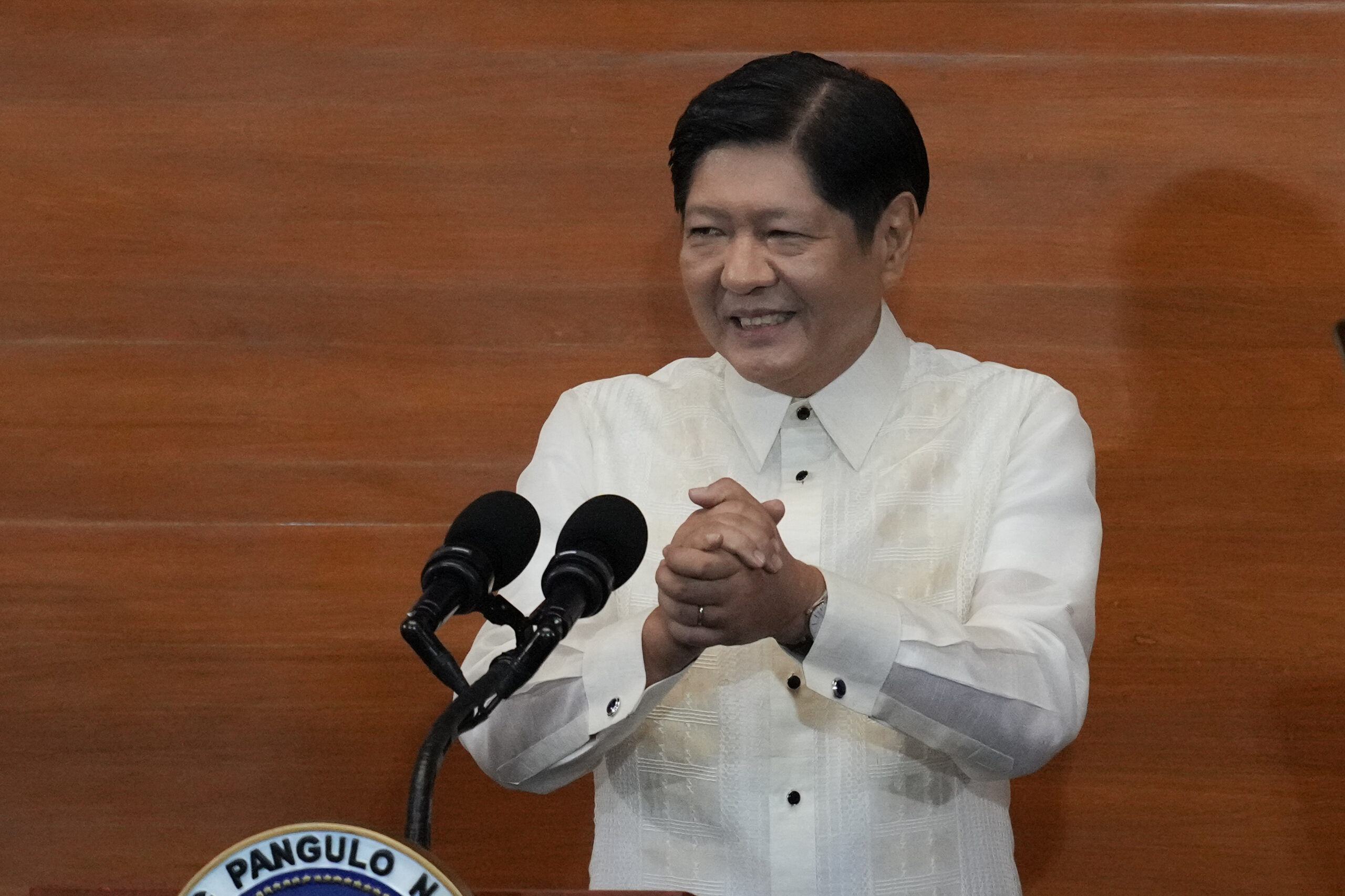

SHOCK AND OUTRAGE: MARCOLETA ACCUSED OF “AVOIDING RESPONSIBILITY” UNDER PUBLIC PRESSURE!

SHOCK AND OUTRAGE: PUBLIC PRESSURE, RESURFACED STATEMENTS, AND THE CRISIS OF TRUST SURROUNDING MARCOLETA There are moments in public life…

POLICE WAS SPRAYED BY A GIRL WITH A BULALO SAUCE. THIS IS THE ONE SHE KISSED AT THE PARTY. THEY WERE NEIGHBORS.

Title: From Almost Collision to True Love — The Story of Grace and Kopé Grace de los Santos had always…

I CAME HOME EARLY AND MISSED MY HUSBAND’S SERVANT’S HELP — HE ORDERED IT

I CAME HOME EARLY AND MISTAKE HELPING MY HUSBAND’S CUSTOMS — HE ASKED ME TO CLEAN THE CR, SO I…

SURPRISE MY PREGNANT WIFE—BUT MY BLOOD COLD WHEN I SAW IT

SURPRISE MY PREGNANT WIFE—BUT MY BLOOD COLLAPSED WHEN I SAW HER CRAWLING ON THE FLOOR TO CLEAN WHILE MY EMPLOYEES…

Bela Padilla Finally Breaks Her Silence: Reveals She Flew to Paris for Kim Chiu’s Secret Wedding — “It Was Meant to Stay Private”

The Philippine entertainment world is once again buzzing with excitement after a surprising revelation from actress and filmmaker Bela Padilla, who…

MY FLIGHT WAS CANCELLED SO I HAD TO GO HOME IMMEDIATELY — AS SOON AS I OPENED THE DOOR

MY FLIGHT WAS CANCELLED SO I HAD TO GO HOME IMMEDIATELY — WHEN I OPENED THE DOOR, A WOMAN WEARING…

End of content

No more pages to load