Official Confirmation: Seven New GSIS–SSS Regulations Expected to Take Effect From January 2026 — What Seniors Need to Know

As January 2026 approaches, discussions surrounding the country’s pension systems have intensified. Recent official confirmations regarding upcoming adjustments to GSIS and SSS regulations have captured nationwide attention, particularly among retirees, near-retirees, and families who rely on monthly pension support.

While public announcements indicate that seven regulatory updates are scheduled to take effect, many details are still being explained gradually. This has led to mixed reactions across the retirement community—ranging from cautious optimism to understandable concern. For millions of seniors, pensions are not merely financial support; they are a foundation for daily stability, healthcare access, and peace of mind.

This article aims to provide a clear, calm, and structured overview of what these changes generally involve, why they are being introduced, and how pensioners can best prepare—without unnecessary speculation or confusion.

Why Pension Reforms Are Being Introduced

Both GSIS and SSS operate in an environment that is constantly evolving. Demographic shifts, longer life expectancy, rising healthcare needs, and changes in employment patterns all place pressure on retirement systems.

Policy reviews are not unusual. In fact, pension authorities periodically reassess regulations to ensure:

Long-term sustainability of funds

Fair distribution of benefits

Efficient administrative processes

Alignment with current economic conditions

The 2026 adjustments appear to be part of this broader effort to modernize systems that serve millions of members across different generations.

Understanding the “Seven Regulations” – A General Overview

Rather than representing seven separate shocks, the announced changes are better understood as seven regulatory focus areas. These areas address how pensions are processed, reviewed, and delivered—not a sudden overhaul of existing benefits.

1. Pension Payment Scheduling Adjustments

One area receiving attention is payment timing and scheduling. Authorities have indicated efforts to improve consistency and predictability, especially for pensioners who rely on digital payment channels.

The goal is not disruption, but smoother disbursement—reducing delays caused by holidays, system congestion, or verification backlogs.

2. Review of Eligibility and Status Verification

Another focus area involves eligibility confirmation procedures. Periodic verification helps ensure that benefits continue reaching the correct recipients while maintaining system integrity.

For most seniors, this does not mean reapplying for pensions. Instead, it may involve:

Simplified confirmation steps

Digital or assisted verification options

Clearer communication timelines

These measures are intended to prevent confusion rather than create obstacles.

3. Clarification of Benefit Computation Policies

Questions about whether pensions will increase or decrease are common whenever regulations change. Based on current explanations, authorities emphasize clarification and standardization, not arbitrary reductions.

Adjustments may involve:

Clearer formulas

Improved transparency in how amounts are calculated

Better explanation of contribution-based variations

Any adjustments are expected to follow established legal frameworks.

4. Streamlining Documentation Requirements

Many seniors have expressed frustration with paperwork in the past. One of the intended reforms focuses on reducing unnecessary documentation and simplifying submission processes.

This may include:

Accepting alternative forms of identification

Longer validity periods for submitted documents

Improved assistance for those without digital access

The objective is accessibility, especially for elderly members.

5. Digital System Improvements With Human Support

While digital systems offer speed, not all pensioners are comfortable using them. Authorities have emphasized a balanced approach—enhancing online services while maintaining physical and assisted support channels.

This ensures:

Seniors are not excluded

Help desks remain available

Transitions are gradual, not forced

6. Coordination Between GSIS and SSS Records

For members with complex work histories, coordination between systems has sometimes caused delays. One regulatory focus aims to improve data coordination, reducing repeated submissions and processing time.

This benefits pensioners who:

Transferred between sectors

Have mixed contribution histories

Require cross-system validation

7. Strengthened Communication and Public Guidance

Perhaps the most important change is how information is communicated. Authorities have acknowledged that unclear messaging often causes more anxiety than policy changes themselves.

Efforts are being made to:

Release information earlier

Use simpler language

Provide FAQs and community briefings

This helps seniors prepare calmly instead of reacting under pressure.

Why Some Seniors Feel Unprepared

Despite official confirmations, many retirees feel they have not had enough time to fully understand the implications. This reaction is understandable.

Common concerns include:

Fear of missed requirements

Worry about reduced income

Confusion due to online rumors

Difficulty accessing official updates

It’s important to distinguish between confirmed policy directions and unverified interpretations circulating online.

What Pensioners Should Do Now

Rather than worrying, experts suggest focusing on preparation:

Follow official GSIS and SSS announcements only

Avoid relying on unverified social media posts

Check personal records for accuracy

Ask questions through official help channels

Attend community briefings if available

No immediate action is required unless directly advised by authorities.

Addressing Common Misconceptions

Several misunderstandings have spread rapidly. Let’s clarify:

❌ “All pensions will be reduced”

✔ No such blanket statement has been confirmed.

❌ “Everyone must reapply”

✔ Current pensions remain valid unless notified otherwise.

❌ “Digital-only systems will replace in-person help”

✔ Human assistance remains part of the plan.

A Broader Perspective on Pension Stability

Pension systems are built on long-term planning. While change can be unsettling, regular updates are often signs of responsible management rather than instability.

Historically, most regulatory adjustments have aimed to:

Improve efficiency

Protect beneficiaries

Ensure future sustainability

January 2026 should be viewed as a transition point, not a breaking point.

Voices From the Retirement Community

Some seniors have expressed hope that clearer rules will finally address long-standing delays. Others prefer a slower pace of change. Both perspectives are valid.

What matters most is that:

Seniors are heard

Policies remain humane

Transitions are supported

Authorities have acknowledged these concerns publicly.

Conclusion: Information, Not Fear, Is the Key

The confirmation of seven new GSIS–SSS regulations taking effect in January 2026 has understandably drawn national attention. However, these changes should be seen as administrative refinements, not sudden disruptions.

While questions remain, ongoing communication and official guidance will continue to clarify what each adjustment means in practice.

For now, the most important message is simple:

👉 Stay informed, stay calm, and rely on verified sources.

Pensions exist to provide security—not uncertainty—and every effort is being made to ensure that remains true in the years ahead.

News

A Homeless Pregnant Woman Gets Kicked Off A Plane – Moments Later Everyone Regretted It!

Maya sat very still on a cold steel chair in the middle of the crowded airport terminal, as if any…

CLICK READ Part 2: HINILA NG BIYENAN KO ANG UPUAN HABANG BUNTIS AKO — AKALA NIYA NAKAKATUWA

HINILA NG BIYENAN KO ANG UPUAN HABANG BUNTIS AKO — AKALA NIYA NAKAKATUWA, PERO NANG DUMANAK ANG DUGO, NAGLAHO ANG…

Part 2🟢: PUMUNTA AKO SA KASAL NG EX KO PARA MAG-MOVE ON, PERO NANG BUMUKAS ANG PINTO, NANGINIG ANG TUHOD KO NANG MAKITA KO KUNG SINO ANG BRIDE…

PUMUNTA AKO SA KASAL NG EX KO PARA MAG-MOVE ON, PERO NANG BUMUKAS ANG PINTO, NANGINIG ANG TUHOD KO NANG…

“No Bitterness, Only Gratitude”: Actress Ra Senon Opens Up About Why GMA Did Not Renew Her Contract Despite High Ratings

In an industry where success is often measured by ratings, popularity, and longevity, contract renewals are usually seen as a…

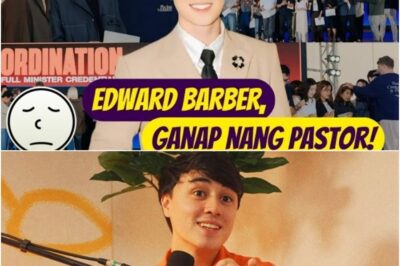

Edward Barber Is Now a Pastor: From Showbiz Stardom to a Life of Purpose and Faith

Once known as one-half of the wildly popular love team MayWard, Edward Barber has now stepped into a role far removed…

INIMBITA ANG “MAHIRAP” NA EX-WIFE SA KASAL PARA IPAGYABANG ANG YAMAN — PERO NATIGILAN ANG

INIMBITA ANG “MAHIRAP” NA EX-WIFE SA KASAL PARA IPAGYABANG ANG YAMAN — PERO NATIGILAN ANG BUONG SIMBAHAN NANG BUMABA ITO…

End of content

No more pages to load