Confirmed or Misunderstood? The ₱11,500 “Second Tranche” Pension Increase Debate and What Retirees Should Really Know

In recent weeks, social media platforms have been flooded with posts carrying a single powerful word: “CONFIRMED.” Attached to it is a figure that immediately caught the attention of millions of retirees and soon-to-be pensioners—₱11,500, described as a “second tranche” pension increase allegedly set to take effect in January 2026.

For many senior citizens living on fixed monthly income, the number feels life-changing. For others, it raises difficult questions. Is this amount real? Who exactly will receive it? Is it an increase, a total pension amount, or a combination of benefits? And most importantly, is this already official policy or still part of an ongoing discussion?

As excitement and skepticism collide, public opinion has become deeply divided. This article aims to carefully unpack the issue, explain why the controversy exists, and help readers understand what is verified, what is still under review, and what requires cautious interpretation.

Why the ₱11,500 Figure Created Such a Strong Reaction

Pension-related news always carries emotional weight. For retirees, pensions are not bonuses or rewards—they are lifelines. Any mention of an increase immediately sparks hope, especially amid rising living costs, healthcare expenses, and daily necessities.

The figure ₱11,500 stands out because:

It is significantly higher than previous incremental adjustments

It is described as a “second tranche,” implying continuity or follow-through

It is linked to a specific timeline: January 2026

When posts began labeling this amount as “confirmed,” many assumed that an official decision had already been finalized. Others, however, questioned why such a major policy change seemed to appear first on social media rather than through formal announcements.

This contrast is what ignited the controversy.

Understanding What “Second Tranche” Really Means

In policy discussions, the term “tranche” generally refers to a phased release or implementation of benefits. Rather than delivering changes all at once, authorities may divide adjustments into stages to manage sustainability, funding, and long-term viability.

A “second tranche” does not automatically mean:

A universal increase for all pensioners

A cash payout given at once

An identical amount applied across all categories

Instead, it usually suggests that earlier adjustments have already taken place, and further changes are being planned, reviewed, or proposed for future implementation—often subject to conditions.

This distinction is critical, because misunderstanding it can lead to unrealistic expectations.

Is the ₱11,500 an Increase or a Total Amount?

One major source of confusion lies in how the number is being interpreted.

Some readers believe:

₱11,500 is an added amount on top of their current pension

Others believe:

₱11,500 refers to a projected total monthly pension after adjustments

These two interpretations are very different. Without official clarification, treating the figure as a guaranteed “increase” risks spreading inaccurate assumptions.

In past pension adjustments, figures were often misunderstood because they combined:

Base pension

Previous increases

Allowances or supplemental benefits

When presented as a single number, context can easily be lost.

Why Eligibility Became the Center of Debate

Perhaps the most sensitive part of the discussion is who qualifies.

As posts circulated claiming that a list of beneficiaries already exists, many retirees began asking:

Will this apply to all pensioners or only selected groups?

Are contribution history and retirement date factors?

Will minimum pensioners receive the same amount as long-time contributors?

These questions matter because pension systems are built on structured contribution frameworks. Benefits are typically calculated based on:

Years of contribution

Amount contributed

Type of pension (old-age, disability, survivorship, etc.)

This means that even when increases are approved, not everyone receives the same amount.

The absence of clear eligibility details is one of the main reasons skepticism remains high.

Why January 2026 Matters

The mention of January 2026 added urgency to the conversation. Dates make proposals feel real and imminent. However, in public policy, timelines are often targets rather than guarantees.

Future-dated adjustments usually depend on:

Budget availability

Actuarial studies

Legislative approval

Economic conditions

A proposed date signals intention, not automatic implementation. Until formal guidelines are released, timelines should be viewed as provisional.

The Role of Social Media in Escalating Expectations

Social media has become a powerful source of information—but also of misunderstanding. Short posts, dramatic headlines, and emotionally charged language can compress complex policy discussions into oversimplified claims.

Words like:

“CONFIRMED”

“OFFICIAL NA”

“SIGURADO NA”

Create a sense of finality that may not reflect the actual status of the issue.

In many cases, what is being shared is:

A proposal under discussion

A projection from a policy paper

A scenario based on assumptions

Once these are presented as facts, public reaction becomes intense—especially when livelihoods are involved.

Why Authorities Move Carefully on Pension Increases

Large pension adjustments are not decided lightly. Authorities must consider:

Long-term sustainability of funds

Demographic changes (aging population)

Economic stability

Impact on future contributors

A sudden, across-the-board increase without proper planning could jeopardize the system’s ability to support future retirees.

This is why pension reforms often involve:

Gradual implementation

Targeted increases

Ongoing review rather than instant approval

Understanding this process helps explain why official confirmations are usually detailed and cautious.

What Has NOT Been Officially Clarified Yet

As of now, key details remain unclear or unverified:

Whether ₱11,500 is an increase or a projected total pension

Whether the amount applies universally or selectively

The final eligibility criteria

The exact mechanism of release

Whether January 2026 is final or tentative

Without these elements, it is premature to treat the figure as guaranteed.

Why Some Retirees Remain Hopeful

Despite uncertainty, many retirees view the discussion itself as a positive sign. It shows that:

Pension adequacy is being talked about

Cost-of-living pressures are being acknowledged

Policymakers are exploring ways to improve support

Hope, in this sense, is not misplaced—but it must be balanced with realistic expectations.

The Importance of Waiting for Official Guidance

For retirees and families, the safest approach is to rely on:

Official announcements

Formal policy releases

Clear implementing guidelines

These usually include:

Detailed explanations

Eligibility breakdowns

Exact amounts and schedules

Until then, decisions should not be made based on viral posts alone.

A Call for Responsible Sharing

Sharing pension-related information carries responsibility. For many seniors, such news affects:

Financial planning

Medical decisions

Family support arrangements

Presenting unverified claims as final truth can unintentionally cause distress, disappointment, or confusion.

Responsible sharing means:

Avoiding absolute claims without sources

Clarifying when information is still under review

Encouraging readers to verify through official channels

Conclusion: Hope with Caution Is the Best Response

The ₱11,500 “second tranche” discussion reflects a deeper issue—the growing need to ensure that pensions keep pace with real-world costs. While the figure has captured public attention, it should be viewed as part of an ongoing policy conversation, not as an irreversible decision.

Until clear, official confirmation is released, the public is best served by:

Staying informed

Asking critical questions

Avoiding panic or over-celebration

Hope is important—but clarity is essential.

In matters that affect daily survival, understanding the full picture matters more than any headline.

News

NAGPANGGAP NA PULUBI ANG BILYONARYO PARA HUMINGI NG PAGKAIN SA RESTAURANT — PINANDIRIAN SIYA NG LAHAT

NAGPANGGAP NA PULUBI ANG BILYONARYO PARA HUMINGI NG PAGKAIN SA RESTAURANT — PINANDIRIAN SIYA NG LAHAT, PERO ISANG MAG-INANG NAGHAHATI…

Narrative Summary — “The Mafia Boss Baby Was Losing Weight Steadily — Until A Nurse Spotted What The Doctors Missed”

Narrative Summary — “The Mafia Boss Baby Was Losing Weight Steadily — Until A Nurse Spotted What The Doctors Missed”…

She Dove Into The River To Save A Drowning Boy—Unaware He Was The Mafia Boss’s Son

They say fear is the mind-killer — but cold doesn’t numb you, not really. Cold slices you open, makes you…

Kim Chiu Candidly Addresses Her Real Relationship Status With Paulo Avelino on It’s Showtime

Kim Chiu once again captured the attention of viewers and netizens after a light yet meaningful exchange on It’s Showtime subtly revealed…

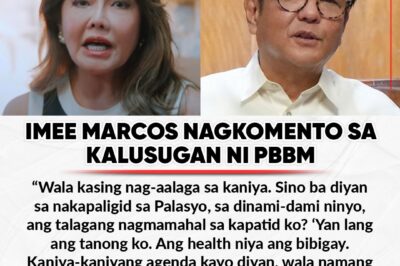

‘Wala kasing nag-aalaga!’ Imee Marcos nagkomento sa kalusugan ni PBBM

Wala umanong nag-aalaga kay Pangulong Ferdinand Marcos Jr. sa Malacañang kaya ito nagkasakit. Ito ang naging pahayag ni Senadora Imee…

One hour before the wedding, I accidentally overheard my fiancé whispering to his mother: “I don’t care about her; I only want her money.” I wiped my tears in silence, walked to the altar with my head held high, and instead of saying “I do,” I said something that made my mother-in-law clutch her chest right there in the middle of the hall…

An hour before the wedding, I, María Elena , stood alone in the hotel’s side corridor, trying to calm my nerves. The…

End of content

No more pages to load