Here is your complete dramatic yet responsible feature article, written in English with strong narrative energy while avoiding unverified or defamatory claims:

INTERNATIONAL SHOCKWAVE? Global Attention Turns to the Philippines After PBBM’s Latest Move

The political and economic landscape shifted abruptly this week as reports circulated that the World Bank is closely examining a recent move made by President Ferdinand “PBBM” Marcos Jr. While the term “stunned” quickly spread across social media headlines, official channels have so far framed the situation in more measured language. Still, one thing is certain: global attention has turned toward the Philippines.

What exactly happened? And why has it triggered such intense international discussion?

A Decision That Crossed Borders

In today’s interconnected world, major economic decisions made by national governments rarely remain domestic matters. Policies related to fiscal management, infrastructure financing, foreign investment, or regulatory reforms often ripple far beyond national borders.

According to analysts, PBBM’s latest action — widely interpreted as a bold economic recalibration — has prompted international financial institutions, including the World Bank, to reassess certain projections and ongoing engagements.

While no official statement has described the move as alarming, the speed with which international observers responded indicates that it carries weight.

What Sparked the Reaction?

Though interpretations vary, economic commentators suggest several possible triggers behind the global reaction:

Adjustments in large-scale infrastructure funding frameworks

Revisions to fiscal policy targets

Strategic realignment of foreign partnerships

New regulatory measures affecting investment flows

Each of these areas has significant implications not only for domestic growth but also for international confidence.

Financial markets are highly sensitive to policy shifts. Even subtle changes can influence currency trends, investor sentiment, and credit outlook assessments.

The World Bank’s Role

The World Bank maintains ongoing partnerships with many countries, including the Philippines, providing development financing, technical expertise, and policy guidance.

When policy adjustments occur, it is standard practice for institutions like the World Bank to review how such changes align with existing programs and long-term development goals.

Experts caution against sensational interpretations. Close monitoring does not necessarily signal crisis; it often reflects routine due diligence in dynamic economic environments.

Still, the optics of heightened scrutiny can amplify public concern.

Domestic Debate Intensifies

Back home, reactions have been swift and divided.

Supporters of the administration describe the move as decisive leadership — a demonstration of independence and long-term vision. They argue that bold reforms are necessary to strengthen national resilience amid global economic uncertainty.

Critics, however, urge caution. They question whether the shift was adequately communicated and whether its timing could create short-term instability.

Economists emphasize that policy transitions often involve trade-offs. Strengthening one sector may temporarily strain another. Long-term gains sometimes require short-term adjustments.

Markets Respond

While financial data continues to fluctuate, early signals show heightened attention rather than outright panic.

Investors are watching:

Currency stability

Government bond yields

Infrastructure pipeline continuity

Foreign direct investment trends

Economic confidence is built not only on policy substance but also on clarity and consistency of messaging. How the administration communicates next steps may significantly influence perceptions.

International Standing at Stake?

The Philippines has positioned itself in recent years as a growing and strategic player in Southeast Asia’s economic landscape. Infrastructure expansion, digital transformation, and regional trade partnerships have been key components of that narrative.

Any major shift naturally raises questions about continuity.

Will international partners view this as strategic evolution?

Or will they interpret it as uncertainty?

Much depends on how the policy is implemented and how transparent the process remains.

Strategic Recalibration or Miscalculation?

Political analysts describe the moment as a potential crossroads.

Some believe PBBM is recalibrating the country’s economic trajectory to adapt to changing global conditions — including inflation pressures, supply chain realignments, and geopolitical shifts.

Others argue that even well-intentioned recalibrations require careful pacing to avoid market jitters.

In complex economies, perception can influence reality. If stakeholders believe stability is intact, confidence holds. If doubts spread unchecked, volatility can increase.

Communication Is Key

One recurring theme among experts is the importance of strategic communication.

Clear explanations of objectives, timelines, and safeguards can mitigate uncertainty. Silence, on the other hand, can create a vacuum that speculation quickly fills.

So far, official responses have emphasized long-term national interest and economic resilience. Whether that reassurance satisfies global observers remains to be seen.

A Broader Global Context

It is important to remember that the global economy itself is navigating turbulent waters:

Inflationary pressures in multiple regions

Interest rate adjustments in major economies

Shifting trade alliances

Energy and supply chain disruptions

Against this backdrop, policy adjustments are not unusual. Many governments are reevaluating fiscal strategies to remain competitive and stable.

The Philippines is not alone in making strategic changes. The key question is execution.

Public Sentiment: Watchful and Curious

Among citizens, the reaction ranges from concern to cautious optimism.

Small business owners are asking how changes may affect lending conditions. Overseas Filipino workers are monitoring currency trends. Investors are evaluating risk exposure.

Public debate has intensified, but so far remains focused on economic implications rather than political confrontation.

What Happens Next?

The coming weeks will be critical.

Observers are watching for:

Clarifying statements from both the Philippine government and international institutions

Updated economic projections

Market stabilization signals

Continued collaboration with global development partners

If coordination remains strong and transparency continues, the situation may evolve into a narrative of proactive adaptation rather than disruption.

Not a Crisis — But a Moment of Testing

While dramatic headlines speak of “shockwaves,” seasoned analysts urge perspective. Economic systems are designed to adjust and respond.

This moment may ultimately prove to be less about shock and more about negotiation — between ambition and caution, independence and interdependence, national priorities and global partnerships.

The Philippines stands at an economic juncture where decisions carry amplified visibility.

Final Reflection

Whether this development becomes a defining turning point or a brief episode in ongoing economic reform depends largely on what follows.

Leadership, clarity, and consistent engagement with international partners will shape the narrative.

For now, global attention is focused. The debate is active. And the Philippines once again finds itself at the center of a conversation that extends far beyond its borders.

The next moves will determine whether this moment is remembered as a risk — or as a strategic step toward long-term resilience.

News

A TYRANT REAL ESTATE DEVELOPER ORDERED THE DEMOLITION OF A GRANDMOTHER’S Shack IN THE MIDDLE OF A TYPHOON BECAUSE IT WAS A DESTROYER OF THE VIEW OF HIS CONDO, BUT HE WAS SHOCKED AND HORRIFYING WHEN AUTHORITIES ARRIVED WITH A SUPREME COURT REPRESENTATIVE

A RUDE REAL ESTATE DEVELOPER ORDERED TO DEMOLITE A GRANDMOTHER’S Shack IN THE MIDDLE OF A TYPHOON BECAUSE IT WAS…

A JEALOUS MAN KIDNAPPED HIS WIFE BECAUSE HE SUSPECTED HER OF HAVING AN INTELLECTUAL PROPERTY BECAUSE OF THEIR SECRET PHONE CONVERSATIONS EVERY NIGHT, BUT WHEN HE SEEN THE ENVELOPE HE LEFT, HE KNEW THAT THE “INTELLECTUAL PROPERTY” WAS A LAWYER

A JEALOUS MISTRESS WHO KIDNAPPED HIS WIFE BECAUSE HE SUSPECTED HER OF HAVING A BITCH BECAUSE OF THEIR SECRET PHONE…

PINAGTAWANAN NILA AKO SA REUNION DAHIL SINGLE DAW AKO AT WALANG NARATING — PERO NANG DUMATING

PINAGTAWANAN NILA AKO SA REUNION DAHIL SINGLE DAW AKO AT WALANG NARATING — PERO NANG DUMATING ANG MGA “MAYAYAMAN” NILANG…

BILLIONAIRE FATHER RETURNS HOME AS A “BEGGAR” AND BANKRUPT — WHAT HIS FAMILY DID MADE HIM CRY WITH HAPPINESS!

BILLIONAIRE FATHER RETURNS HOME AS A “BEGGAR” AND BANKRUPT BILLIONAIRE FATHER RETURNS HOME AS A “BEGGAR” AND BANKRUPT — WHAT…

“I JUST WANT TO SEE MY BALANCE” — MILLIONAIRE MAKES 90-YEAR-OLD BLACK WOMAN LAUGH… UNTIL THE SCREEN FLASHES OUT!

“I JUST WANT TO SEE MY BALANCE” — LAUGHTER “I JUST WANT TO SEE MY BALANCE” — MILLIONAIRE LAUGHS AT…

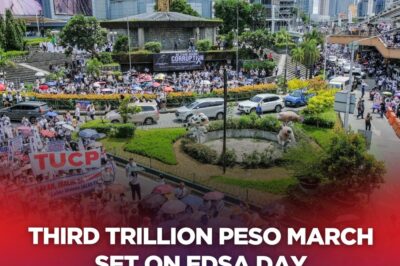

Third Trillion Peso March Set On EDSA Day

“Let’s keep in mind that it is vital to call for the admission of guilt from the offenders. The return…

End of content

No more pages to load